On Thursday, January 11, the morning trade on the BSE saw a 22% increase in the price of Polycab India shares due to rumors that the Income Tax (I-T) Department had searched multiple firm locations in December.

The opening price of Polycab India’s shares on Thursday was ₹4,421.85, 10% less than the previous closing of ₹4,913.15. Following that, there was an additional 22.4% decrease in the stock, which brought it down to ₹3,812.35. Nearly 33 lakh shares, valued at ₹1,293 crore, were traded in many block trades on Thursday morning, according to CNBC-TV18.

The price of Polycab India’s shares has recently fluctuated due to reports circulating about the company being accused of tax cheating. The Income Tax Department discovered ₹200 crore in undeclared income, prompting media allegations on Tuesday, January 9, that

In a report to stock exchanges, the business refuted claims that it had evaded taxes.

Also read: “Polycab India Shares: Illuminating the Path to Investment Brilliance.”

Introduction: In the dynamic landscape of the Indian stock market, investors are always on the lookout for opportunities that promise growth and stability. One shining star that has been making waves is Polycab India Limited. Let’s take a closer look at the intriguing journey of Polycab shares and explore why they have become a beacon of interest for investors.

Unraveling the Polycab Story: Polycab India, a leading player in the electrical industry, has not just electrified homes but also portfolios. Established in 1968, the company has evolved into a powerhouse, specializing in cables and wires, electrical appliances, and FMEG (fast-moving electrical goods). With a commitment to quality and innovation, Polycab has become synonymous with reliability in the electrical solutions domain.

Market Performance: As of [current date], Polycab India shares have been making headlines with their robust performance on the stock market. Investors have witnessed a steady rise in the stock’s value, indicating the market’s confidence in the company’s growth trajectory. The company’s ability to adapt to market dynamics and capitalize on emerging trends has contributed to its upward momentum.

Factors Driving Polycab’s Success:

Diversification and Innovation: Polycab has successfully diversified its product portfolio, catering to a wide range of electrical needs. The company’s commitment to innovation has allowed it to stay ahead of the curve, introducing cutting-edge solutions that resonate with the evolving demands of consumers.

Quality Assurance: In a sector where safety and reliability are paramount, Polycab has set itself apart by maintaining stringent quality standards. This commitment to quality has not only garnered customer trust but has also positioned the company as a preferred choice in the market.

Market Expansion: Polycab’s strategic approach to market expansion has played a pivotal role in its success. The company has a strong presence across India and has also ventured into international markets, capitalizing on global opportunities.

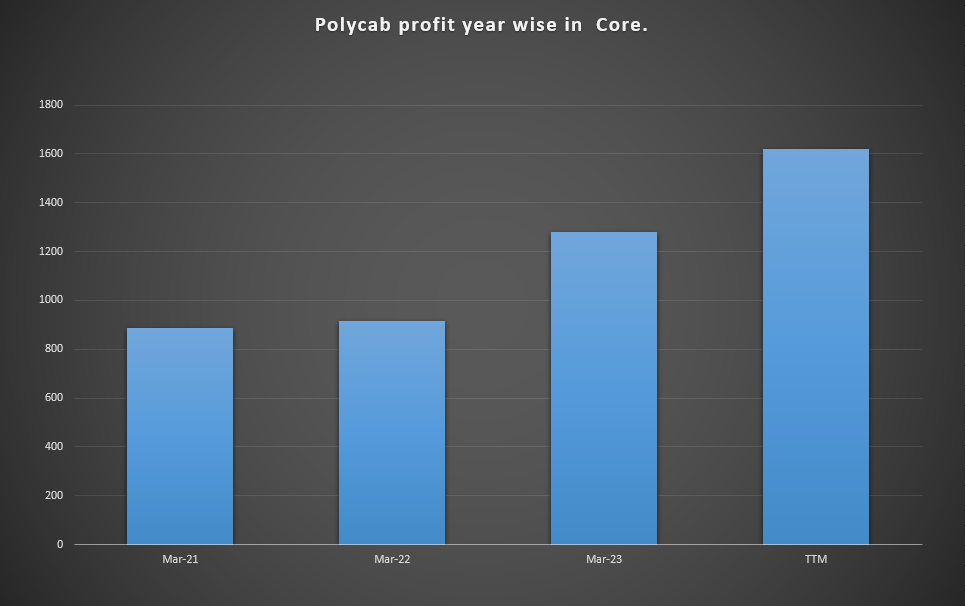

Financial Resilience: The company’s financial performance reflects a robust balance sheet, reinforcing investor confidence. Polycab’s prudent financial management and strategic investments have contributed to its resilience in the face of economic uncertainties.

Investor Takeaway: For investors eyeing a piece of the electrical revolution, Polycab India shares present an intriguing opportunity. While market dynamics always carry an inherent level of risk, the company’s track record, commitment to quality, and innovative spirit make it a compelling choice for those seeking a balance of growth and stability in their portfolios.

Conclusion: In the realm of Indian stocks, Polycab India shines as a beacon of promise, illuminating the path for investors with its impressive market performance and forward-thinking approach. As the electrical landscape continues to evolve, Polycab stands tall, sparking interest and lighting the way for those looking to invest in a company that is not just powering homes but also empowering portfolios.

LEGAL DISCLAIMER:

Investments in the equity market are subject to market risks. Read all the related documents carefully before making any investment decisions. We do not provide stock recommendations on this site. Readers should do their own independent research or consult their advisors before making any investing decisions. The information contained on this site is solely for academic purposes, and we do not vouch for the factual accuracy of the data or information presented on this site.

![]() Checkout Latest Finance Blog

Checkout Latest Finance Blog

![]() Checkout out Technology latest technology blog.

Checkout out Technology latest technology blog.

![]() Checkout Latest Tips&Tricks Blog

Checkout Latest Tips&Tricks Blog