In the fast-paced world of financial markets, mastering the art of day trading and swing trading is akin to navigating a labyrinth of opportunities. One key aspect that traders often delve into to decipher market movements is the fascinating realm of chart patterns. These visual representations of price action unfold like an intricate tapestry, revealing potential trends and reversals. In this blog, we will explore the nuances of day trading and swing trading chart patterns, unveiling the secrets behind these captivating formations.

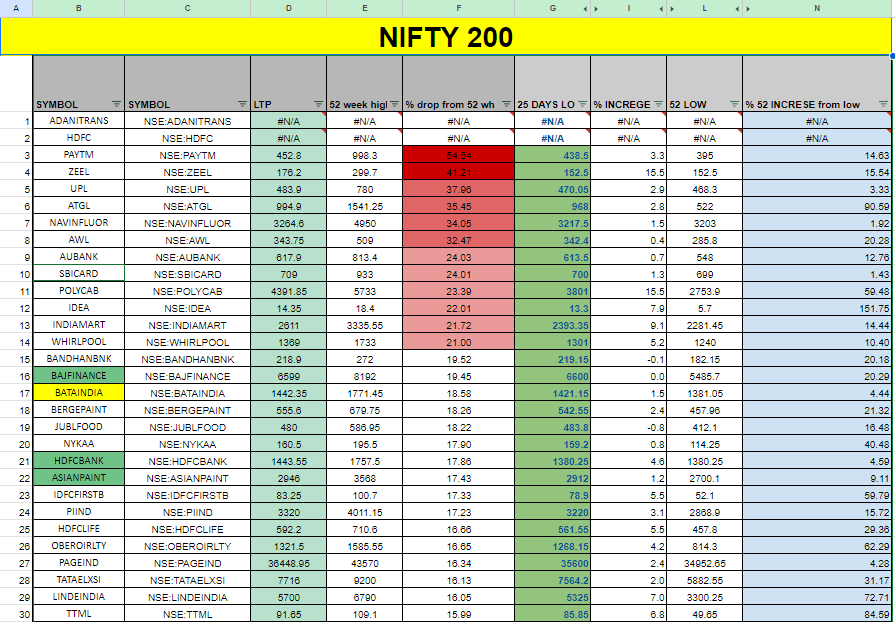

NIFTY200 important googlesheet chart find here. click here

The Symphony of Candlesticks Day Trading and Swing Trading:

At the heart of chart patterns lie the candlesticks, each telling a unique story of price dynamics. Day traders and swing traders alike can decipher trends through patterns like the engulfing pattern, doji, and hammer. These candlestick formations are the building blocks of chart patterns, providing crucial insights into market sentiment and potential price reversals.

Triangles: The Geometric Dance of Continuation:

Triangles, with their geometric precision, are a day trader’s playground. Whether it’s ascending, descending, or symmetrical triangles, these formations represent a period of consolidation before a potential breakout. Recognizing the subtle shifts in market sentiment within these triangles can be the key to unlocking profitable trades.

Head and Shoulders: The Classic Reversal Ensemble:

No discussion on chart patterns is complete without the iconic head and shoulders formation. This classical reversal pattern resembles, well, a head and shoulders. Traders keen on spotting trend reversals often find themselves at home with this pattern, using it as a roadmap for potential entry and exit points in the market.

Cup and Handle: Sipping from the Earnings Elixir:

For day trading and swing trading eyeing long-term gains, the cup and handle pattern is a timeless classic. This formation, resembling the shape of a teacup, signifies a brief consolidation period followed by a potential breakout. Traders with patience may find themselves sipping from the earnings elixir as they ride the upward trend that often follows.

Double Tops and Bottoms: Echoes of Reversals:

In the symphony of chart patterns, double tops and bottoms play the role of an echo, signaling potential trend reversals. Day traders skilled in spotting these mirror-image formations can capitalize on the psychological shifts in the market, seizing opportunities for quick profits.

Fibonacci Retracements: The Golden Ratio in Day Trading and Swing Trading:

While not a traditional chart pattern, Fibonacci retracements are an indispensable tool for both day traders and swing traders. Derived from the golden ratio, these retracement levels act as potential support and resistance, helping traders identify entry and exit points with a touch of mathematical elegance.

Conclusion:

Day trading and swing trading chart patterns are not merely lines and shapes on a screen; they are the footprints left by market participants, telling a tale of supply, demand, and market sentiment. Mastering the artistry of chart patterns requires a combination of technical skill, intuition, and a deep understanding of market dynamics. As traders embark on the journey of decoding these patterns, they unveil the secrets that can lead to profitable moves and a deeper appreciation for the intricate dance of financial markets.

DEMATE ACCOUNT OPENING WITH MY SUPPORT.

opening link button for ZERODHA

opening link button for FYERS

opening link button for UPSTOCX

Opening link button for PAYTM MONEY

NIFTY200 important googlesheet chart find here. click here

Important Day trading and swing trading chart patterns (Chart of the week for long term gain )

- Au small finance bank (11-02-2024)

- NAVIN FLUORINE (09-02-2024)

- HDFCBANK (06-02-2024)

- ASIANPAINT (03-02-2024)

- VEDANT FASHION /MANYAVER (24-01-2024)

- DMART (23-01-2024)

- ATUL LTD (23-01-2024)

IF YOU DONT HAVE DEMATE ACCOUNT YOU CAN OPEN HERE THROUGH MY REFERAL LINK WITH MY SUPPORT :

-

Zerodha Demat Account Opening

Steps to open Zerodha account online

- Go to Zerodha.com website and click on Sign Up Now using your mobile number and email address.

- Verify the mobile number and email ID by putting the respective OTPs.

- Enter your PAN no. and Date of Birth.

- Make the payment of account opening fees for desired segments through UPI or Net banking.

- Click on Connect to DigiLocker to sign in to DigiLocker.

- Allow Zerodha to access DigiLocker and share a copy of Aadhar with the broker.

- Verify the Aadhar details.

- Enter personal details like bank details, background information, tax residency, and Continue.

- Write the OTP displayed on the screen on white paper for IPV.

- Allow Zerodha access to the webcam to complete the IPV and click on capture.

- Upload the soft copies of the above documents and E-sign based on Aadhar.

- Click on E-sign Equity that takes you to the NSDL site.

- Verify your email ID by putting the security code.

- Verify the account opening form and click on Sign now.

- Enter the Aadhar no. and OTP on the NSDL website and click on submit.

Document required

- Aadhar Number

- PAN Number

- Canceled Cheque (Scanned) or

- Bank Statement (Scanned)

- Signature Copy (Sign on an empty paper and scan)

-

Fyers Account Opening

Steps to open Fyers account Online

- Visit the Fyers website

- Click on ‘Open An Account’ tab on the home page

- Enter mobile number, email and name and click on ‘Generate OTP’

- An OTP will be sent to your mobile phone

- Enter the OTP and follow the process

Once you submit the online account opening application, Fyers will review it and send you the welcome email in 24 hrs. The email also contains your client id and password which you can use to login and being online trading or investment in the stock market.

-

Upstox Account Opening

Document required

- Aadhar Number

- PAN Number

- Canceled Cheque (Scanned) or

- Bank Statement (Scanned)

- Signature Copy (Sign on an empty paper and scan)

Note-Make sure that your Aadhar Number is linked with your correct mobile number. The process of online account opening requires you Aadhar number validated using OTP.

Steps to Opening Upstox Account (Using Aadhar)

- Visit Upstox.com and go to account opening page.

- Create an account by entering your email ID, creating a password and mobile number.

- Enter your PAN card, Aadhar Card and verify with OTP sent on your mobile.

- Pay the required fees for opening the account through the integrated payment gateway. The fees are based on the type of instruments like Equities, Derivatives, and Commodities etc., you want to trade.

- Upload the documents mentioned above and choose the pricing plan.

- Review and confirm the application.

- Submit the application.

- In a few minutes, you will receive an email with 2 attachments- a Demat form and a PoA (Power of Attorney) form.

- You will receive the User ID and password required to sign in to your Upstox account with 24 hours of the activation of the account.

-

Paytm Money Account Opening

Steps to open Trading and Demat account with Paytm Money

The account opening at Paytm Money is classified into four stages. To open the trading and Demat account with Paytm Money, you need to follow the below steps.

- Download the Paytm Money App.

- Log in using the existing ‘Paytm’ credentials. In case you do not have a Paytm account, sign up afresh to create a Paytm account with an email id or mobile number.

- Verify the mobile number by entering OTP received on the mobile number.

- Click on ‘I want faster access’.

- Submit all the necessary documents required for Paytm Money KYC verification.

- Complete the Stock market onboarding process by providing your trading experience and trading preference.

- Complete the Aadhar based E-sign on the account opening form.

- The broker will register the client details with the exchange and CDSL. Once the registration gets completed, the broker informs the client of the account activation.

You will be notified of completion at each stage of onboarding on the home dashboard screen of the app once you log in. At each stage requires, you are required to submit specific data. Below is the detailed stage-wise account opening process.

Stage 1: KYC Verification for Stock Market.

- Enter your PAN No. to check your investment readiness status.

- Upload PAN Card Photo in case your KYC is not verified.

- Add personal details like full name, date of birth, gender, marital status, profession, Parents name, and Save.

- Sign on the screen or upload a photo of your signature and save it.

- Upload your photograph.

- Complete the In-Person Verification (IPV) by uploading a 5-second video introducing yourself. Then click on Submit.

- Add your address and upload an address proof and Submit.

- Add a nominee (optional step).

- Declare your annual income and tax status.

- Enter your bank details like the IFSC code and account number.

- Verify the bank details by uploading a bank account proof.

- Click on Exploreunder the Stocks tab and click on Start Investing.

- Set a 4-digit security passcode.

- Click on Start and Open My account.

With this, the first stage gets completed. You can start the second stage once you see the green tick on your KYC status with a message as ‘Your details are successfully verified’ that denotes that your Paytm Money KYC is verified.

Stage 2: Stock Market Onboarding

- Click on Complete Now that opens a pre-filled account opening form.

- Read the terms and conditions and click on Submit.

- Select the exchange and trading segment and confirm.

- Update trading experience.

- Sign in dark ink on white paper, click the photo, and upload your signature.

- Click on Okay and Next.

This completes the Stock Market Onboarding Stage. You can proceed to the next stage once you see the green tick on the second stage with a message as ‘Your details are successfully verified’ that denotes that your stock market onboarding is complete.

Stage 3: Account Opening Form (AOF)

- Click on Complete Now to E-Sign the AOF.

- Grant the location access and Proceed.

- Enter the Aadhar number on the NSDL E-sign service portal and click on Send OTP.

- Enter the OTP received on the linked mobile number and verify the OTP.

This completes the E-signing process. You are now just a step away from the account activation.

Stage 4: Registration with Exchanges: There is no action required from the client/investor in this stage. Paytm Money will complete the registration process of the client with Exchanges and Depository and notify once done.

Once all the stages are complete and ticked in Green, your account gets marked as Investment ready

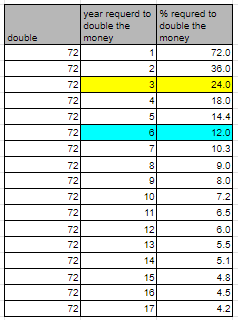

The time required to double the money

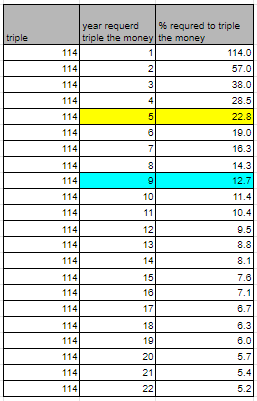

The time required to triple the money

LEGAL DISCLAIMER:

Investments in the equity market are subject to market risks. Read all the related documents carefully before making any investment decisions. We do not provide stock recommendations on this site. Readers should do their own independent research or consult their advisors before making any investing decisions. The information contained on this site is solely for academic purposes, and we do not vouch for the factual accuracy of the data or information presented on this site.

![]() Checkout Latest Finance Blog

Checkout Latest Finance Blog

![]() Checkout out Technology latest technology blog.

Checkout out Technology latest technology blog.

![]() Checkout Latest Tips&Tricks Blog

Checkout Latest Tips&Tricks Blog